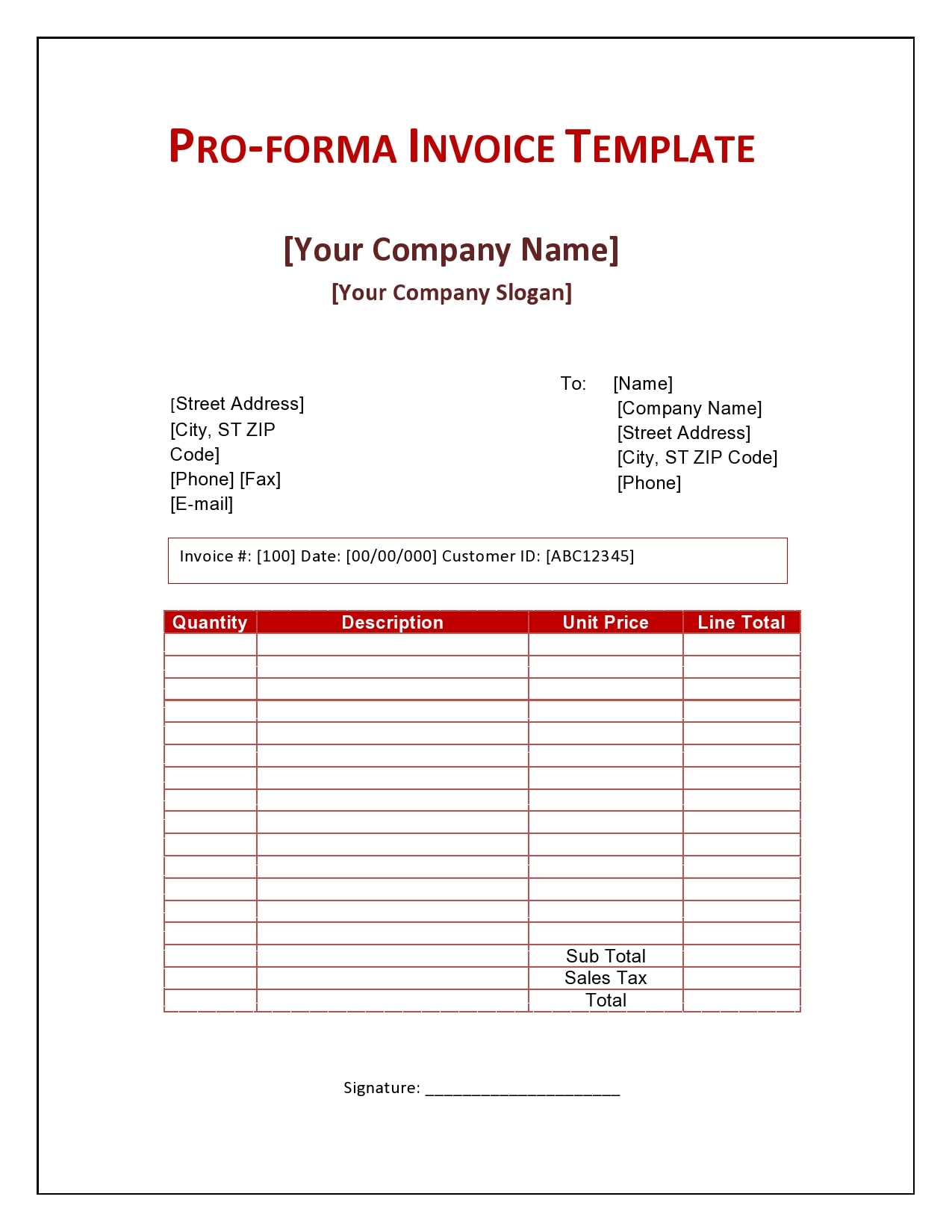

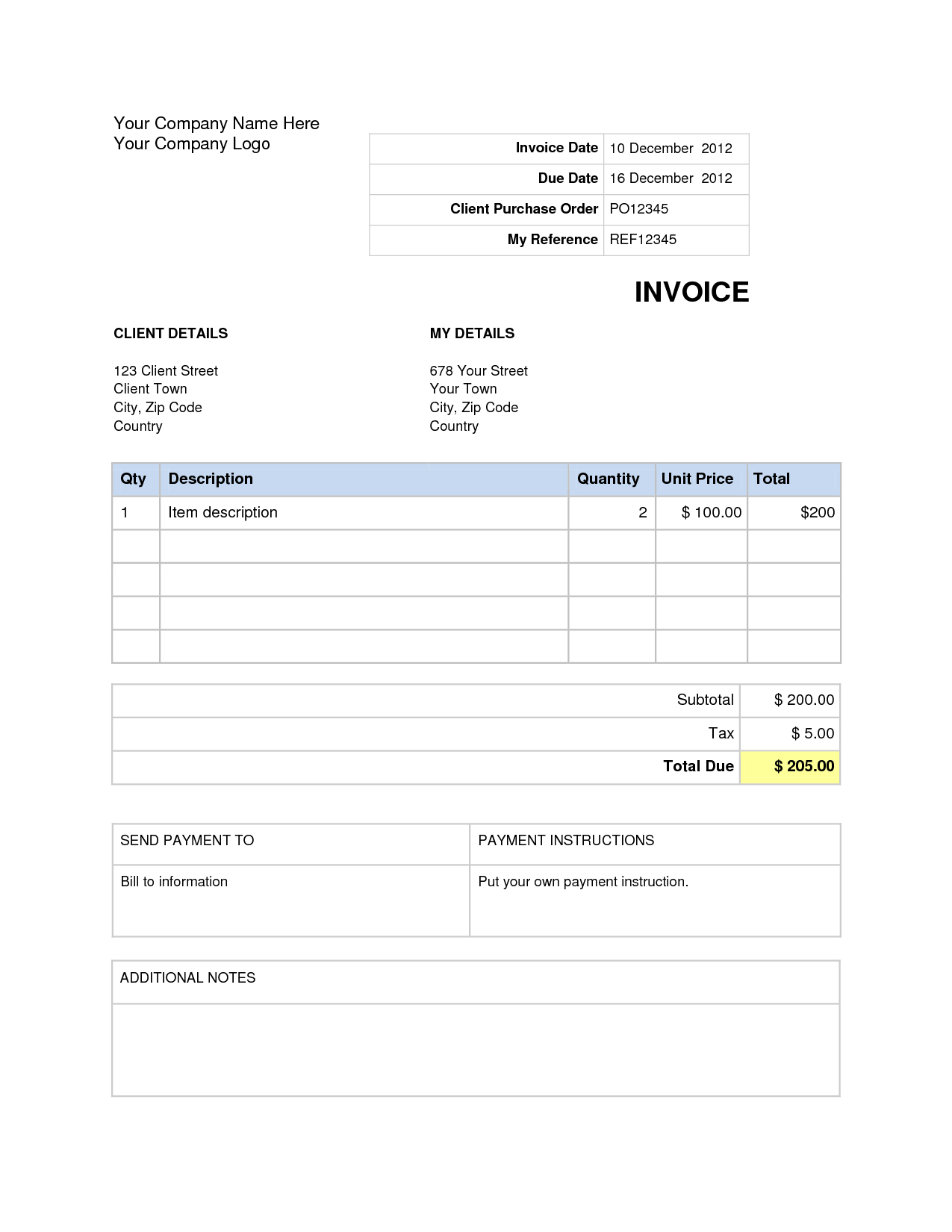

Once the first table has completed, repeat the process for any labor services being charged.įor the Word version, multiply the ‘subtotal’ field by the ‘sales tax’ field, and add the result to the ‘subtotal’ amount to find the invoice’s ‘total’ amount. In the Word version, the seller will need to calculate each amount field manually. In the PDF version, the amounts will calculate automatically. Next, in the first table, enter the products the client is being charged for. Address (Street, City, State, and ZIP Code)įor the ‘Bill-to’ section, enter the name of the individual or company being billed, the invoice (or quote) number, their customer ID (if applicable), address, and the date that the invoice will be issued.Then, enter the following regarding the company in the upper-right corner: Start by entering the name of the company issuing the invoice in the upper-left corner.

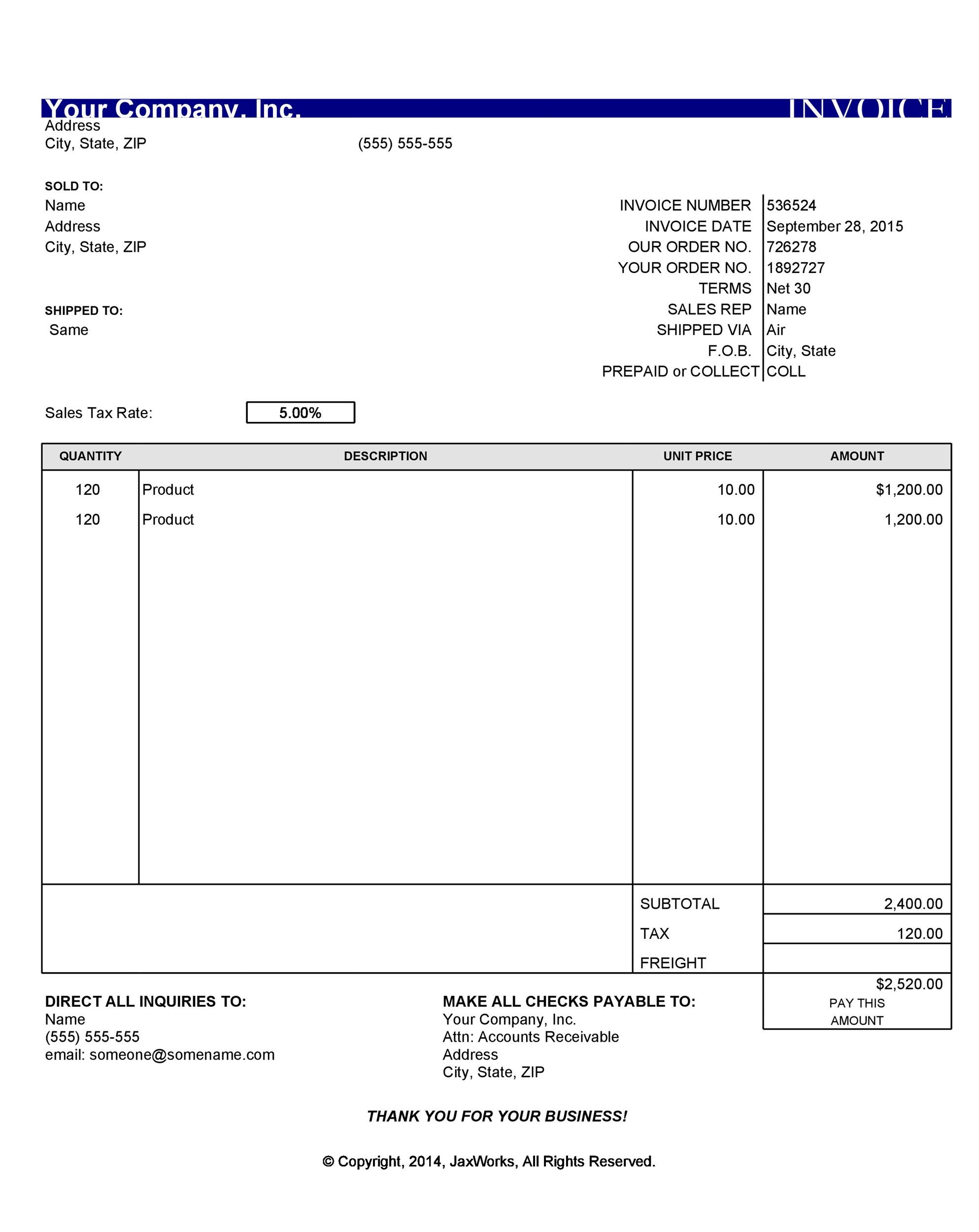

Proforma Invoice (Version 3) – Includes fields for VAT and other international shipping fields.ĭownload the Proforma Invoice in either PDF or WORD.

Proforma Invoice (Version 2) – A one (1) page invoice that includes ample room for listing all products and contains a signature field for approval. Provides buyers with the total cost of an order in addition to shipping. UPS Commercial Invoice – If an individual or company will be shipping goods out of the US with UPS (United Parcel Service), they must complete this form to ensure the proper tariffs/taxes are charged on the goods.ĭHL Proforma Invoice – For use with DHL shipping only. A form needs to be individually printed-out and inserted into each shipped package (cannot use 1 for multiple).

0 kommentar(er)

0 kommentar(er)